Fima CORPORATION Berhad

(197401004110) (21185-P) •

Annual Report 2020

83

PRINCIPLE B: EFFECTIVE AUDIT AND RISK MANAGEMENT

I.

AUDIT AND RISK COMMITTEE

The Committee which has been renamed as Audit and Risk Committee on 22 June 2020, is an important element of the Group’s

governance structure. The Audit and Risk Committee is chaired by Encik Rezal Zain bin Abdul Rashid and the members are Dato’ Adnan

bin Shamsuddin, Datuk Bazlan bin Osman and Encik Rosely bin Kusip, all of whom are Independent Non-Executive Directors. The

experience and qualifications of members of the Committee are disclosed in the Profile of Directors section of this Annual Report. The

Audit and Risk Committee has a written Terms of Reference which is available on the ‘Investors’ section of the Company’s website.

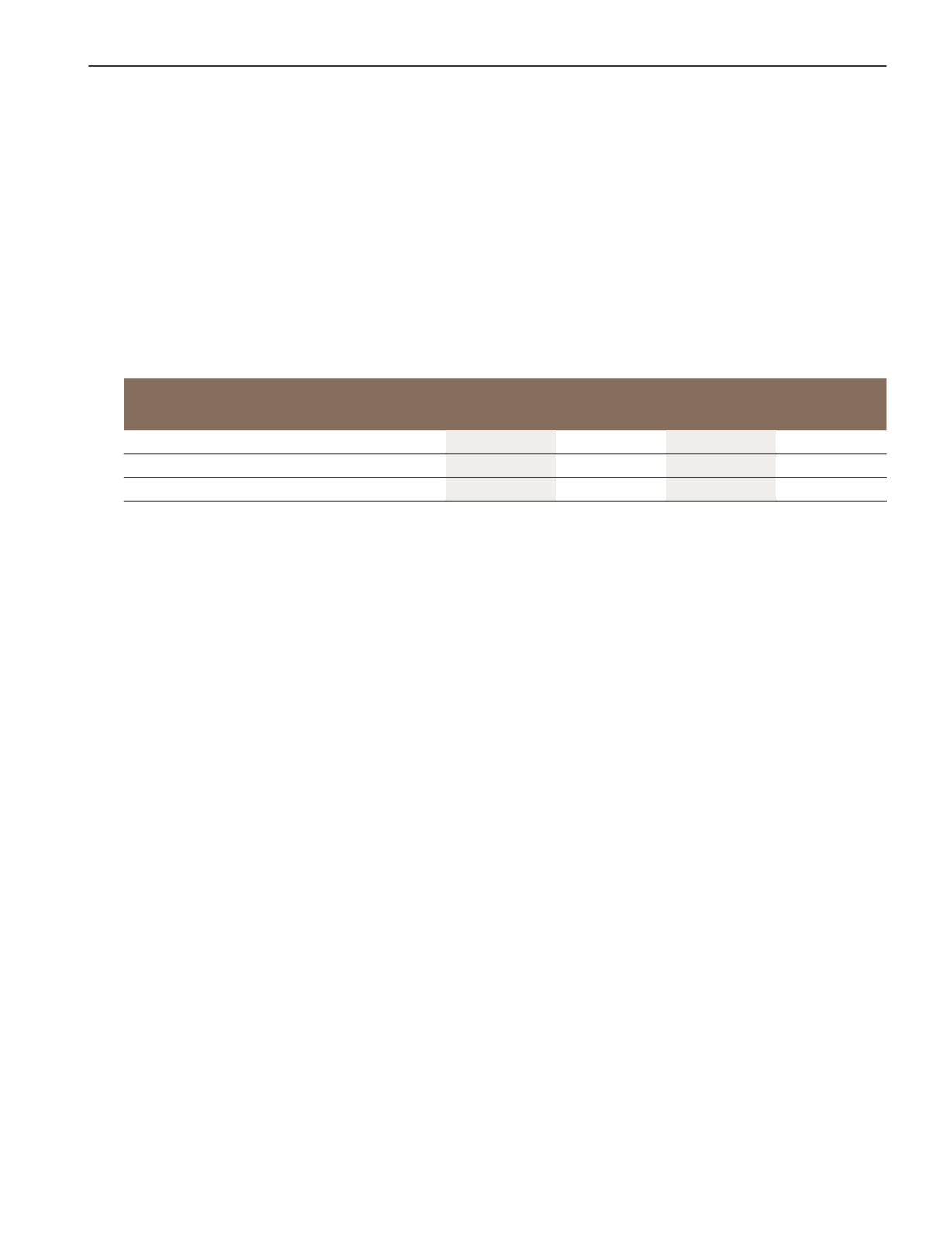

The particulars in relation to the audit and non-audit fees incurred by the Company and its subsidiaries for the FYE2020 are as

follows:

Audit Fees (RM’000)

Non-Audit Fees (RM’000)

2020

2019

2020

2019

Company

93

83

10

10

Subsidiaries

272

270

187

209

TOTAL

365

353

197

219

Information about the Audit and Risk Committee, including its work in FYE2020 are set out in the Audit and Risk Committee Report

contained in this Annual Report.

II.

RISK MANAGEMENT AND INTERNAL CONTROL FRAMEWORK

The Board recognizes the importance of effective risk oversight, riskmanagement and internal control for good corporate governance

and is committed to embedding risk management practices to support the achievement of business objectives and fulfil corporate

governance obligations. The Board is responsible for reviewing and overseeing the risk management and internal control framework

for the Group and for ensuring the Group has an appropriate risk management and internal control process and procedures. The

Audit and Risk Committee provides advice and assistance to the Board in meeting that responsibility and the role of the former in

relation thereto is described in the Statement on Risk Management and Internal Control of this Annual Report.

The Group has an enterprise riskmanagement framework which is designed to provide a sound framework for managing thematerial

risks of conducting business. The framework sets out the standards and processes for identifying, monitoring and reporting of risks

impacting the success of strategic objectives and operating plans.

The Board however, recognizes that the enterprise risk management framework must continually evolve to support the type of

business and size of operations of the Group. As such, the Board will, when necessary, put in place appropriate action plans to further

enhance the Group’s risk management and internal control framework.

Related Party Transactions

An internal compliance framework exists to ensure its obligation under the Bursa Listing Requirements, including obligation to

related party transactions and recurrent related party transactions. The Board, through the Audit and Risk Committee, reviews and

monitors all related party transactions and conflicts of interest situation, if any, on a quarterly basis. A Director who has an interest in

a transaction must abstain from deliberating and voting on the relevant resolutions, in respect of such a transaction at the meeting

of the Board and AGM.

Details of the proposed renewal of shareholders’ mandate for recurrent related party transaction is set out in the Circular/Statement

to Shareholders dated 28 August 2020.